The calculated advance milk price in March 2015 averaged € 31.76 per 100 kg standard milk. A decrease of € 0.12 compared to the previous month. Compared to March 2014, this is a decrease of € 8.51 or 21.9%.

The calculated advance milk price in March 2015 averaged € 31.76 per 100 kg standard milk. A decrease of € 0.12 compared to the previous month. Compared to March 2014, this is a decrease of € 8.51 or 21.9%.

Less changes

Most dairy companies have not changed their milk prices in March compared to February. The French milk prices have slightly reduced (from – € 0.2 to € – € 0.7), but that is consistent with seasonal adjustments in previous years. The drop in the milk price of Finnish Hameenlinnan Osuusmeijeri is also seasonal.

Contrary to the decreases of Milcobel (- € 1) and Dairy Crest (- € 1.2) milk prices of Müller (+ € 1) and FrieslandCampina (+ € 2.4) increased. The relatively sharp rise in the milk price of FrieslandCampina is due to a correction of their guaranteed milk price of approximately 1.75 euros due to lower than estimated milk prices of their reference companies in January.

Rest of EU and USA

The calculated milk price of Arla will rise in April by € 1.55 and remain unchanged in May. The milk prices of Friesland Campina declines in the coming months, namely minus € 0.73 in April and minus € 1.24 per 100 kg in May.

The calculated milk price of the Swiss Emmi is reduced, because of a compulsory levy to contribute to the export of dairy products. The fall in Swiss milk prices in national currency is much greater than shown in euros, because the conversion is based on a (much) lower value of the euro or in other words more euros per franc.

Above applies in varying degrees for the calculated milk prices of all non – euro countries. As an example the calculated milk price for the United States in March 2015 is € 35.64. If this milk price would be calculated using the euro exchange rate of a year earlier, in March 2014, it would be 22% lower, or € 27.95 per 100 kg.

Switzerland and Euro

The calculated milk price in March is little changed compared to the previous month. But it should be noted that the milk price in February is corrected retrospectively from € 52.47 to € 48.65 due to a levy for export. Since the decision of the Swiss National Bank in mid-January 2015 to abolish the minimum exchange rate of the euro against the Swiss Franc the value of the euro has fallen from 1.20 to 1.06 CHF. The more expensive franc has very negative consequences for the Swiss dairy sector because the revenues of the export of especially cheese (Emmentaler) has fallen. Besides a drop in the milk prices Swiss dairy farmers also contribute to the additional export costs through a deduction from the milk money (the so called “Schoggisgesetz” levy).

The milk price decrease in national currency is much higher than in euros, because milk prices are converted from francs to euros with a depreciated euro or in other words more dollars per franc.

MARKET SITUATION

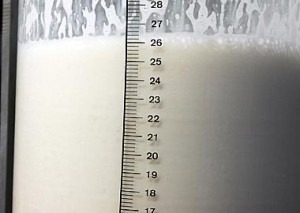

Official Dutch dairy quotations (€ per 100 kg)

29/04/2015 1/04/2015 2/1/2014

Butter 302 318 406

Whole milk powder 268 279 379

Skimmed milk powder 185 201 330

Whey powder 77 81 99

Less demand and sufficient supply led recently to lower prices on the dairy market. The expected further growth in milk supply keep milk buyers cautious. However, the weak euro has a positive effect on exports to the world market, a structural improvement of the market depends on an increase of demand, for example because China is more explicit in the market.

Thanks to Willem Koops of www.milkprices.nl for this summary.