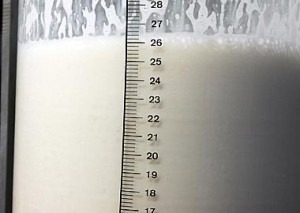

The calculated advance milk price in January 2016 averaged € 28.86 per 100 kg standard milk. A decrease of € 0.54 compared to the previous month. Compared to January 2015, this is a reduction of € 2.87 or 9.0%.

The calculated advance milk price in January 2016 averaged € 28.86 per 100 kg standard milk. A decrease of € 0.54 compared to the previous month. Compared to January 2015, this is a reduction of € 2.87 or 9.0%.

Decrease in January

In January most milk prices decreased. The calculated milk price of British Dairy Crest fell the most (€ 3.2 per 100 kg), due to no season bonus in January and the devaluation of the British pound against the euro. The milk price of Lactalis decreased sharply (€ 1.8) followed by DMK and DOC (each minus € 1.0), FrieslandCampina (- € 0.7), Sodiaal (- € 0.6), Muller (- € 0.5) and Bongrain (- € 0.3). The milk prices of Milcobel, Glanbia, Kerry and Granarolo remained unchanged, while the calculated milk price of Danone increased (+ € 1.5). The calculated milk price of Arla increased slightly (+ € 0.1) due to a change in the ratio of protein and fat price.

Coming months

For the coming months, Arla (February – € 1.0) and FrieslandCampina (March – € 0.7) as well as British Dairy Crest (- € 2.0 in March) announced price cuts. As of January 2016 the milk prices of the British First Milk and Finnish Hameenlinnan Osuusmeijeri will no longer be calculated. This is because the milk price data are no longer be supplied and therefore it was decided to add other dairy companies the coming months.

Due to this change the new average of 14 dairy companies is no longer comparable with the average of the 16 companies in the previous publications. However, retroactively from January 2010 onwards a (new) average of 14 milk prices is calculated. So the fall of € 0.54 and € 2.87 respectively refers to the average of 14 dairy companies and not to the previously published averages.

Fonterra and USA

Fonterra: End of January Fonterra revised their milk price for the current season 2015/16. The forecast milk price decreased from 4.60 to 4.15 per kg milk solids. Including an estimated dividend of 0.5 the calculated milk price of Fonterra is from June 2015 onwards based on 4.65 per kg milk solids.

USA: – 2.1.The US Class III milk price decreased from to $ 14.44 in December to $ 13.72 per hundredweight (45.36 kg) in January.

Market situation

Official Dutch dairy quotations (€ per 100 kg)

3/3/16 3/2/16 7/1/2015

Butter 236 264 272

Whole milk powder 186 195 221

Skimmed milk powder 163 165 173

Whey powder 50 51 74

Not only in the Netherlands but also in other countries in northwest Europe still much more milk is produced. Outside Europe, the growth os somewhat slowing down. In New Zealand, since the start of the new milk year milk production is at a lower level compared to last year, although the gap is less than earlier forecasts. In the US a noticeable slowdown in the growth of the milk production was observed in the last months of 2015 and production January was only 0.3% higher than in January 2015.

Fundamentals

The fundamentals in the dairy market, namely the long time less positive development of global demand and excess supply, remain unchanged. Because of this imbalance stocks (public and private) increase and prices remain under pressure. The skimmed milk powder price moves around the intervention price level. The price of butter and whole milk powder has not yet reached the bottom but moves further down. In February, as a result, the EU butter price moves more and more to the level of intervention.

That the market is still under pressure, is also evident from the results of the GDT auctions since mid-January. Both the prices of skimmed and whole milk powder as also the auction price of butter fell sharply. Although this decline with a slight plus in the overall index GDT early March (+ 1.4%) came to a standstill, it seems there is still no turnaround in the market.

Thanks to Willem Koops from ZuivelNl and www.milkprices.nl